Victims of an £11.5m boiler room fraud lost £300,000 in a scam that left some people on the brink of suicide.

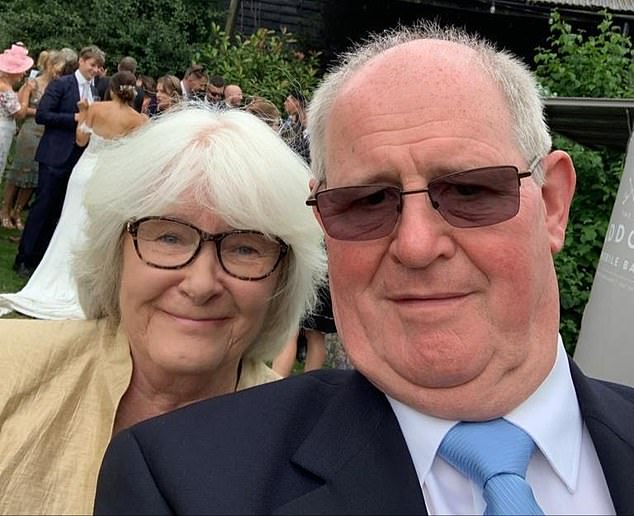

Gareth and Marilyn Hamblin had no reason to suspect they were about to lose a significant amount of their retirement pot when they invested in the company.

Mr Hamblin, a ship’s chief engineer who has spent nearly half a century at sea, had thought for some time about where to invest the family’s money.

After spotting CEX Markets’ advert online and being attracted by the potential returns offered, Mr Hamblin travelled from the family home in Oxfordshire to meet with a CEX representative at their swanky offices in central London in the summer of 2017.

The Hamblins originally invested £5,000, and then two significantly larger sums. So far so good, and Mr Hamblin’s plan to retire aged 65 the following year off the back of the investment looked to be paying off.

Marilyn and Gareth Hamblin lost out on more than £300,000 after they were scammed by Jonathan Arafiena who convinced the couple to invest heavily in worthless shares

Jonathan Arafiena, 35, conned his victims out of their life savings for worthless shares

The court heard how Arafiena spent victim’s money on high-end goods including a £205,000 Rolls Royce (pictured)

‘We were in regular contact with them, they showed us our investment was maturing well, everything looked like it was going in the right direction,’ Mr Hamblin, 70, told MailOnline.

‘I did my homework on them, met with them, had a specific point of contact and regular updates – we just didn’t suspect a thing.’

But it all turned out to be the most elaborate ruse, and with his retirement goal in sight, Mr Hamblin’s world came crashing down.

‘It was in the latter part of 2018, I was at sea, and I thought I would check the account online, but I couldn’t access it,’ he said.

‘I realised it had folded. We had been scammed’

He made an urgent, frantic call to his wife.

‘He was so distraught that I was concerned for his safety and as we were separated by 6,000 miles,’ Mrs Hamblin said.

‘I felt helpless.’

Mr Hamblin, too, admits the situation was so depressing that he found it impossible to talk about.

After spotting CEX Markets’ advert online and being attracted by the potential returns offered, Mr Hamblin travelled from the family home in Oxfordshire to meet with a CEX representative at their swanky offices in central London in the summer of 2017

One of a number of luxury watches Arafiena owned. At least 350 people across Great Britain are known to have invested in the scam, although police believe others have not come forward due to embarrassment or having died since the swindle began eight years ago

Arafeinia vast collection of luxury goods. Not a single penny was actually invested that he scammed, although around £3.3 million passed through Arafiena’s personal bank account

‘If we had put money into something and it innocently goes belly-up, you can live with that,’ he said.

‘But this was fraud – they tricked us from day one that we were making money when in fact they were stealing from us and, I think, hundreds of others.’

Far from being able to retire and spend his time with their two adult children, grandchildren, and extended family, Mr Hamblin has had little choice but to continue working into his seventies.

Powerful victim impact statements read to the court yesterday underlined the human impact of this multi-million-pound scam, with tales of victims’ shame, embarrassment and regret at being duped.

Mrs Hamblin said: ‘My husband has spent almost 65 per cent of his working life away from home on ships all over the world for long periods of time.

‘This he has done to provide for his family and with a view to his retirement at the age of 65.

‘My husband has now had to continue to work at sea to try to make up the money which was stolen from him and at 70 years of age he is still working – that is why he is not in court with me today.

‘Apart from the loss of the money, the mental anguish for the past six years has at times been almost more than we could bear.

‘My husband continues to blame himself for the loss of the money he was counting upon for his/our retirement although he exercised all reasonable due diligence, including meeting a supposed representative of CEX, before committing to the investment.’

She added: ‘We are devastated and look to recover all our monies, by whatever means, from these thieves.’

The court heard Arafiena was ‘instrumental’ in spending money from a so-called boiler room fraud, where a legion of cold callers coaxed would-be investors into parting with their personal fortunes on the promise of handsome returns.

People swimming in the swimming pool bridge between two apartment blocks in Embassy Gardens (stock image). Arafiena owned a flat in the apartment building in south London which cost more than £110,00 a year

But victims never saw their money again, and only twigged that their cash had been stolen when they were suddenly unable to access their accounts.

At least 350 people across Great Britain are known to have invested in the scam, although police believe others have not come forward due to embarrassment or having died since the swindle began eight years ago.

Prosecutor Karen Robinson said Arafiena was heavily involved in the ‘operation and continuation of the money laundering scam’ which spent the ill-gotten gains.

She said that he was ‘not someone who otherwise had the ability’ to afford the lifestyle he was living ‘by legitimate means’.

Arafiena, of Vauxhall, was finally stopped in 2019, when several victims contacted Action Fraud, and City of London Police began investigating.

The prosecutor said he had been shelling out vast sums to rent swanky apartments, including one in south London well known for its swimming pool ‘bridge’ which cost more than £110,00 a year, and spending victims’ money on high-end items including a £205,000 Rolls Royce, £330,000 of gold bullion, and £14,000 on concierge services.

He also spent £250,000 to pay off his parents’ mortgage, the court heard.

Arafiena had been using a series of fake names including John Mayer and Christian Ocean to carry out his crimes but was caught when detectives used mobile phone data and airline passenger manifests to link him to the fraud.

It is understood the scam involved dozens of shell companies, often fraudulently set up using investors’ identities, to launder money.

Not a single penny was actually invested, although around £3.3 million passed through Arafiena’s personal bank account.

The court heard Arafiena, who has a previous conviction for money laundering more than a decade earlier, was assisted by 43-year-old website creator Kofi Ofori-Duah, of Wanstead, and 35-year-old Ashlee Morgan, from Lambeth, Arafiena’s ‘right-hand man’.

Police said the duo also got a cut of the victims’ money.

All three pleaded guilty to concealing, converting, transferring or removing criminal property.

Kieran Vaughan KC, defending Arafiena, said his client was ‘deeply remorseful and bitterly ashamed’ and suggested there were others involved in the scam who had not been convicted.

He said Arafiena ‘was engaged in a legitimate business… but became involved with people which led him to being involved’ in the scam.

Rhodri James, for Ofori-Duah, said his client felt ‘shame and disappointment in himself’. He was handed a two-year suspended sentence.

And defence counsel William England said Morgan felt ‘genuine remorse’ that what he did was ‘wrong’. Morgan was handed an 14-month suspended sentence.

Simon Styles, financial investigator with City of London Police, said the prosecution helped give a voice to victims across the country.

He said: ‘This lifestyle was beyond the dreams of 99.9 per cent of the public, they invested their money in good faith and so it was a real kick in the teeth to see what their money was being spent on.

‘I’ve been in the police for more than 40 years and this fraud was right up there as one of the biggest, and Arafiena was the kingpin in this case.’

Sian Mitchell, from the Crown Prosecution Service, said: ‘The money that these criminals laundered came from a highly sophisticated and professional fraud that has devastated the lives of hundreds of hard-working people, who were tricked into investing in bogus companies.

‘Victims have had their lives and future plans irreparably damaged, with hopes for retirement or leaving an inheritance for children and grandchildren destroyed.’

She said the CPS will now legally pursue all three defendants to strip them of the proceeds of their offending.